| The Markets Apart from HSBC, all of the UK's largest lenders have agreed to sign up to the Bank of England's Funding for Lending scheme, which began in August. The scheme allows institutions to borrow up to 5% of their loan books and so far a total of 13 firms have signed up, with the BoE noting that a number of additional banks and building societies are close to joining. HSBC's reason for not participating is that it does not need any additional capital. Over in Spain, a police perimeter has been set up around the parliament building in Madrid, in preparation for a planned protest against austerity measures. Thousands are expected to attend the event, but organisers have claimed it will be a peaceful march. At the London close the Dow Jones was up by 44.47 points at 13,603.39 and the Nasdaq was up by 11.79 points at 2,855.77. In London the FTSE 100 rose by 20.87 points to 5,859.71; the FTSE 250 finished 28.32 points ahead at 11,931.43; the FTSE All-Share gained 11.85 points to 3,058.98; and the FTSE AIM Index declined by 2.22 points to 708.81.

Broker Notes Panmure Gordon reiterated its "sell" recommendation for UBM (UBM), but with an increased target price of 620p, from 450p. The broker approves of the firm's strategy to exit the data services businesses and focus solely on events hosting. Panmure values the firm's data services division at 220 million pounds, noting that the disposal would reduce the group's gearing, but warned that it may be difficult for it to attain this price, due to falling EBIT margins. The shares climbed by 14.5p to 717p.  N+1 Brewin maintained its "buy" rating for Oilex (OEX) with a 9.3p target price. The broker believes that the oil and gas explorer's recent equity raising of 7.1 million Australian dollars (4.6 million pounds) should provide it with sufficient working capital to complete its drilling and flow testing campaign at Cambay. Brewin noted that an independent consultancy estimated that the firm has net recoverable resources of 222 billion cubic feet of gas and 37 million barrels of oil at the site. Shares in Oilex leaked by 0.25p to 3.875p. Shore Capital retained its "buy" stance for Millennium & Copthorne (MLC), noting that the hotel chain's shares continue to trade at a 25% discount to its net asset value, while a number of its peers rallied last summer. The broker said that the current share price only accounts for the group's core portfolio and does not account for its stake in CDL Hospitality or its under-performing hotels. On Shore's forecasts, the shares trade on a prospective earnings multiple of 14.7 times for 2012, falling to 14.2 times in 2013. Millennium & Copthorne advanced by 7p to 505p. Blue-Chips Alcoholic drinks company Diageo (DGE) confirmed that it is in discussions with United Spirits, which may result in Diageo acquiring strategic control over the Indian distiller, significantly increasing its presence in the country. It is rumored that tycoon Vijay Mallya, who holds a 28% stake in United Spirits, is looking to raise funds to support his struggling Kingfisher airline. Diageo shares gained 30p to 1,754p.

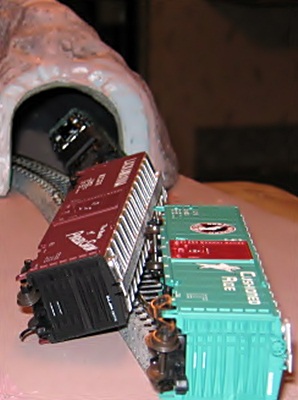

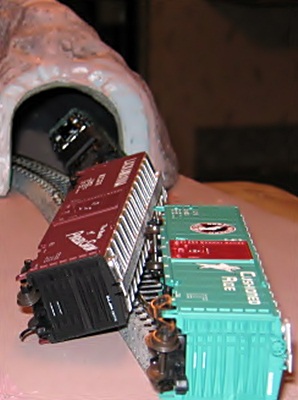

Xstrata (XTA) announced that it's 303 million Australian dollar (186.7 million pound) Lady Loretta mine in Queensland, Australia, has begun production ahead of schedule. The miner said that the first load of zinc, lead and silver ore will be shipped for processing later this month and the firm noted that full scale production should begin by mid 2013, with a target rate of 1.2 million tonnes of ore per year. The site contains an estimated 12.7 million tonnes of resources and has an expected mine life of 12 years. The shares fell by 19.8p to 980p. Consumer goods company Reckitt Benckiser Group (RB.) reported that it has voluntarily discontinued the supply of Suboxone tables, an opioid medication, raising concerns over high levels of children accidentally taking them. The firm said that the tablet containers were not sufficiently child proof but noted that it has seen much lower levels of ingestion of its new Suboxone Film, which it noted had significantly improved child resistant packaging. We would also note that the tablets, pictured below, look remarkably like children's sweets,such as a Pez. Shares in Reckitt slipped by 29p to 3,609p.

The now discontinued Suboxone tablets Mid-Caps Close Brothers Group (CBG) reported pre-tax profits of 134.9 million pounds for the financial year ended 31st July 2012, up 71.8% on 2011's performance. The financial services company noted that its banking division achieved a 27% increase in adjusted operating profits to 135 million pounds, but its securities division saw operating profits tumble 55% as it struggled to cope with difficult market conditions. The firm added that the restructuring of its Asset Management division resulted in a reduction in losses to 4.3 million pounds, from 8.6 million pounds. Shares in Close Brothers inched down by 5p to 845.5p.

In order to increase its presence in North America, rat catcher Rentokil Initial (RTO) has agreed to buy US peer Western Exterminator Company for an initial cash consideration of 99.6 million dollars (61.4 million pounds). The firm noted that the acquisition will make it the third largest pest control business in North America, in terms of revenues. As at 31st December 2011, the target had gross assets of 36.7 million dollars (22.6 million pounds) and generated revenues of 149 million dollars (91.8 million pounds). Shares in Rentokil edged down by 0.45p to 82.95p. Euromoney Institutional Investor (ERM) said that it has been trading in-line with expectations for the period from 25th July to date, adding that it expects fourth quarter revenues to be broadly flat on 2011's comparable period. The business and finance magazine publisher forecasts full year revenue growth of 9%, including 6% attributable to contributions from acquisitions. It also expects to finish the year with a net debt position of no more than 40 million pounds, down from 88.5 million pounds as at 31st March. The shares grew by 12p to 769p. Small Caps, AIM and PLUS Shares in Zoo Digital Group (ZOO) soared by 6p to 19.5p after the company confirmed that the strong trend it enjoyed in the second half of the prior financial year has continued into the new year and that it has remained profitable. The creative media services business said that its core market of film entertainment has stabilised after a long period of uncertainty, adding that it is continued to develop new products and targeting new clients. KBC Advanced Technologies (KBC) reported pre-tax profits of just 0.7 million pounds for the six months ended 30th June, down from 2.2 million pounds in the first half of 2011 and warned that it will not meet its previous full year targets. The energy consultant suffered from a number of major contract delays, as clients remain cautious in the poor economic climate. The group also announced plans to raise 1.35 million pounds through an equity placing of 50p per share, a 25.4% discount to the closing price on 24th September, in order to provide working capital. The shares tumbled by 14p to 53p. Talking of profit warnings, toy train set manufacturer Hornby (HRN) said that the sale of merchandise based on the London Olympics were not as good as originally expected. Large retailers were forced to offer heavily discounted prices and, as a result, cancelled a number of repeat orders. Meanwhile, the company warned that a rationalisation programme at one of its major suppliers in China has resulted in significant disruption to shipments. Shares in Hornby collapsed by 30.25p to 58.25p.

Hornby looks to be derailed

Resource Holding Management (RHM), formerly RedHot Media, announced gross profits of 8.8 million Malaysian ringgits (1.8 million pounds) for the six months ended 30th June, up 1% year-on-year, despite revenues falling by 28% to 20 million ringgits (4.0 million pounds). The advertising and marketing company attributed the performance to increased focus on higher margin products, such as out-of-home and digital media. The firm added that it is continuing to seek businesses to acquire to enhance its capabilities in these sectors. The shares rose by 0.5p to 13.5p. Lighting technology company PhotonStar LED Group (PSL) saw revenues for the six months ended 30th June rise by 50% year-on-year to 3.82 million pounds and reduced its pre-tax loss to 0.53 million pounds, from 0.72 million pounds. The firm established two new production facilities during the period and also benefited from the acquisition of Camtronics. The group remained confident of future growth, forecasting LEDs to account for 50% of the 100 billion dollar (61.6 million pound) general lighting industry by 2015, compared to current levels of 19%. PhotonStar shares swelled by 1.25p to 10.5p. PLUS-quoted Bioventix (BVXP) reported revenue growth of 21% for the year ended 30th June 2012, to 2.4 million pounds, with pre-tax profits rising by 39% to 1.5 million pounds. During the year, the medical diagnostics company's flagship product, the vitamin D antibody vitD3.5H10, reached large scale manufacture and the firm noted that it has secured a number of new licensing deals with major diagnostics companies. The shares gained 8p to 225p. Regenersis (RGS) said that it made two key acquisitions in the year ended 30th June, with the purchase of HDM for 6.5 million euros (5.2 million pounds) expanding its presence in Spain, Mexico and Argentina, while the acquisition of a Swedish business for 0.25 million euros (0.20 million pounds) have it a foothold in the Nordic market. The electronics repair company also reported pre-tax profits of 1.7 million pounds for the year ended 30th June, up from just 0.26 million pounds in 2011 and reduced its net debt by 0.9 million pounds to 2.9 million pounds. Regenersis shares climbed by 14.5p to 105.5p. |

No comments:

Post a Comment